5 Safeguards to Prevent Mileage Expense Fraud

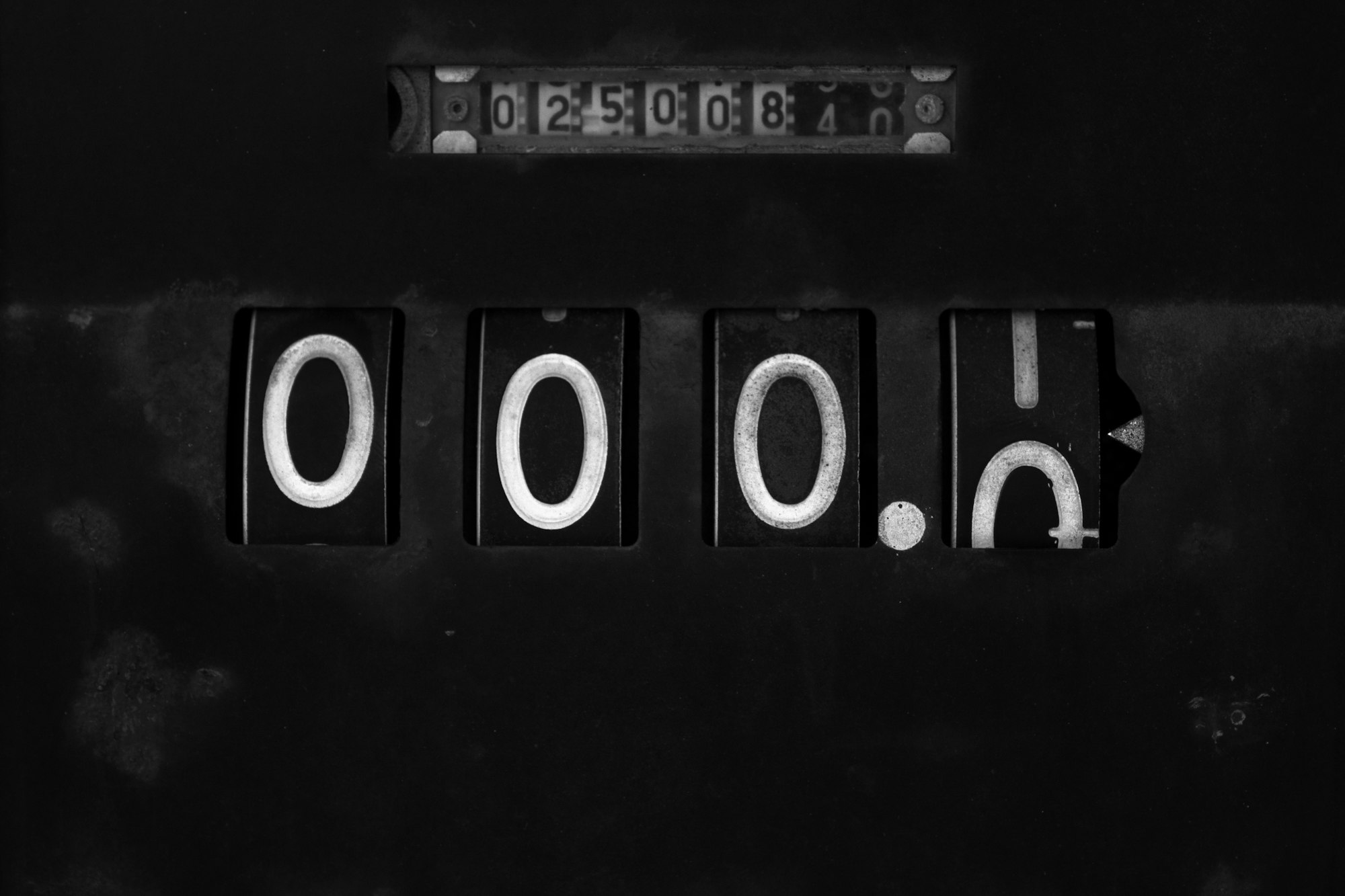

$40,000. That's the median loss for a company per single expense reimbursement fraud case.

According to the 2016 Report to the Nations on Occupational Fraud and Abuse, expense reimbursement fraud - in which an employee makes a claim for reimbursement of fictitious or inflated business expenses such as travel or meals - is one of the most prevalent types of occupational fraud. Expense reimbursement fraud accounts for 16% of all fraud cases sampled in the US, 17.5% in Canada, 18% in Europe and 18% in Asia-Pacific. The median loss for each such case is $40,000.

It's a lot easier and cheaper to prevent fraud by adopting proper safeguards than it is to find and handle a fraud case after the act. When it comes to mileage expense reimbursement, we recommend these important principles for tracking, reviewing, approving and reimbursing mileage claimed by employees:

- Avoid manual trip logging

Ensure that trips are logged automatically based on GPS hardware that is either installed in the employee's vehicle or using the employee's mobile phone.

When employees have to record trips manually - by entering data into a form, excel sheet or even an app - two issues arise: firstly, errors and inaccuracies are bound to occur due to accidental (or intentional) entry of false data and secondly, it is hard to validate the reported data. The employer has no effective measure to audit reported trips and ensure they were actually made, show accurate mileage and are indeed work-related.

Automating trip tracking by collecting real-time location data from a GPS-enabled device solves these two issues by providing both accurate and error-free recording of mileage.

- Require evidence

Ensure that mileage expense reports include detailed location information per trip. This includes a map showing the full, actual route taken as well as times of departure/arrival and places visited. This data must be attached as a supporting document to each trip claimed by the employee.

- Ensure data immutability

Trips logged by employees are like entries in a ledger. They must be immutable once recorded such that location data, places and times cannot be modified. This is a critical aspect of a mileage tracking system and a prerequisite for fraud prevention.

- Separate modes of travel

Ensure that expensed trips clearly indicate the mode of travel and the vehicle used in each segment of the trip. For starters, driving should be logged separately from walking. If you reimburse employees for mileage made with their bicycle or by public transportation, it should also be clear which mode of travel was used in each segment of the trip, because different rates could apply for different travel modes.

- Require contextual information

Reviewing mileage and trip data is meaningless if the employee does not provide context for each trip claimed. This includes the purpose of the trip as well as any work-related info, such as project or client name associated with this trip. To facilitate that, choose a mileage-tracking tool that allows employees to easily include notes, tags or other meta-data for each logged trip.

About Psngr

Psngr is a mileage expense tracking, reporting and reimbursement platform for enterprise.